What Is Wrong With Cryptocurrencies?

How I lost interest in financial privacy.

| TEUN VAN SAMBEEK |

|---|---|

| 18 FEBRUARY 2025 |

Understanding the flaws of available ”solutions” is the main reason to keep looking for other solutions. If solutions are presented as systems to withdraw yourself from the system, but actually are designed to lure descending voices in, it is better to be aware of it in time.

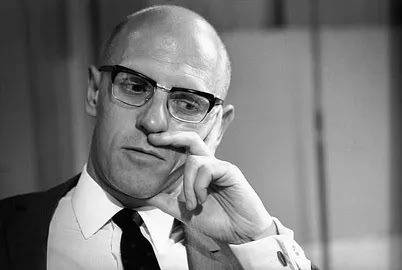

”The greatest form of resistance to power is not confrontation, but refusal. Power thrives on submission, on the expectation that we will comply. The most effective way to deny it is not by fighting it head-on, but by withdrawing what it craves—our consent, our participation, our obedience. When we stop feeding the system, it loses its grip. Power is only as strong as the consent it receives; deny it, and it withers.”

Michel Foucault

The biggest struggle before assessing what is wrong with the world, is to assess what is wrong with yourself. When you want to focus on creating a new solution, the biggest hurdle is to overcome indoctrination and prejudices.

When you discuss your solution with others, you are basically trying to break these hurdles. Initially, you are not talking directly to each other personal cores, but are trying to reach someone through 2 layers of indoctrination and prejudices, through the layer of the other individual and your own layer.

”It's easier to fool people than to convince them that they have been fooled.”

Mark Twain

Financial Privacy

When there was no money, just barter, financial privacy was not a real thing. There could be a problem of theft of crop, cattle, clothes, shoes or any other product you produced, but hiding the existence of your products was in most cases not really possible.

This changed with precious metals and precious stones. It was obviously better to hide these valuables and not expose them, as people could steal them. Only people with real power - like kings and queens - didn’t seem to be too afraid to showcase their wealth.

When gold turned into gold coins and gold coins turned in to paper IOU's, this privacy issue, became stronger and was even advised by the people that were starting to run banking operations. They told their clients to only reveal their wealth to the bank but never to others to avoid the risk of being scammed or robbed.

Businesses were forced to hire accountants to reveal their income and wealth to the banks and governments, so taxes could be taken. These accounting reports had to be made public. Income tax declarations of the individual people could however be kept secret, except for the government and if you wanted to get a loan from the banks.

As long as the people didn’t question the democratic process and trusted the financial and government oversight institutions, and only feared their potential criminal fellow citizens, personal financial privacy seems to be a sensible feature to have and maintain.

The Corrupt Politicians Trick

”Give me control of a nation's money supply, and I care not who makes its laws.”

Mayer Amschel Rothschild

Mayer Amschel Rothschildfounder of the Rothschild banking dynasty

Mayer Amschel Rothschildfounder of the Rothschild banking dynastyIf you look at the year that each country in West Africa suddenly - without a fight - became independent and compare that with the year their own central bank was founded, then you will see what Rothschild meant.

Once you issue the currency of a nation, it is very easy to corrupt politicians. Each country needs to have many corrupt politicians, so the people will think that it is the corruption of the people they have chosen themselves, are the ones that caused the misery the people are in. This will make them think that - if they vote harder and better next time - a ”good politician” can save the people from all these bad politicians from the past. When you own the media to control the narrative around politics, you can play this game for many decades. And once people really get tired of that game, you put them in a real depression or war, to distract them from the political trickery.

When the first Corona measures were installed in the Netherlands, there was a small group of influencers that came with the hashtag #ikdoenietmeermee, meaning ”I stop participating now”. The immediate response was unbelievable. Within hours, all these influencers had to be crushed. It was amazing to see how that initiative stroke a bad, painful nerve. It was very clear that it was exactly what the power that are in control fear the most.

Cryptocurrencies

Out of nowhere came Bitcoin. And as a miracle, it also was listed at an exchange that was allowed to exist. The stories around the creator Satoshi Nakamoto were fantastic and the users were portrayed as real cyber anarchists. Once Bitcoin became mainstream, an endless row of other cryptocurrencies were developed. Some of them with extreme sophisticated privacy features, like Monero and Pirate chain.

Most of the proponents of the crypto-technology will say that cryptocurrencies are the best system to escape the power of banks and the governments the owners of the central banks control. But is it? It all looks a bit too good to be true.

My Beef With Bitcoin (And Other Crypto)

I will list a number of points that clearly disqualify cryptocurrencies as a proper successor to the fiat currencies. Before I list them, I first want to get to the quote of Michel Foucault. He said ”The most effective way to deny the current powers, is not by fighting it head-on, but by withdrawing what it craves—our consent, our participation, our obedience.”

The current powers allowed cryptocurrencies to exist. The current powers don’t fight it, they allow it and even embrace it. Trump has been launching all kinds of meme-coins, already causing billions of damage among his supporters and has promised to make the country the crypto capital of the world. If cryptocurrencies would be a threat to the financial system it would have NEVER been allowed on ANY trade platform.

When I would be able to print money out of thin air for over 350 years, and I would own 99% of all assets in the world (worth about a 1000 trillion dollars), then I would have only one worry: How do I keep my privilege?

Now to find out how I can keep my privilege, I am able to spend trillions of dollars (that will be just added to the debt of governments). I would use that money to research how I can keep this privilege and also to execute the measures that make me keep my privilege. Creating cryptocurrencies is certainly one of the measures that I would take.

When the internet became popular, I - as the owner of the financial system - would need measures to crush any ideas about alternative financial systems that cyber punks might develop.

So when you own the CIA as your army of spies, you funded Darpa, Facebook, Google, Microsoft, and Apple and you own all the financial regulators in the world, how difficult do you think it would be to create something like Bitcoin? You need to create encryption like SHA256, put a backdoor in it and then standardize the encryption method. Then you use your freshly printed fiat to purchase over 90% of each cryptocurrency of any meaning. Next you punish all people that think crypto can ever become a threat to Fiat currencies with boom and bust cycles. To me that sounds like a very solid, useful strategy.

In 2016 I myself, started to think about using encryption to create UBI to create a system that enabled everyone to afford a house. I even bought some crypto, I learned how to program SHA256 encryption, how to program hashing routines and how to create blockchains. I did this only to learn what you can create with these tools. With that knowledge, I started to build alternative solutions to the clearly insane Fiat currency system.

But the more prototypes I tried, the more clear it became that encryption and hiding your identity is not the solution. As Michel Foucault indicates: “Don’t focus of the fight with the current powers. Don’t fight using their systems.” I understood that I shouldn’t think that democracy or a financial system where you hide your wealth and identity will keep you safe. It is not possible. You need to leave the battlefield where the rules are defined by the enemy. Just leave it behind, and create a new world from scratch. That is what they fear the most. So that is what I focused on from that moment on.

My Crypto Problem List

But okay, let’s continue with my list:

The “average” human (for example a random visitor of a public market in Nigeria) will never be able to keep his private key safe. Especially if it unlocks a cryptocurrency that is labeled illegal by the government. Through their connections with big tech, those private keys will be intercepted by for example key-loggers or other spy routines in the operation systems of the smartphones.

The ownership of cryptocurrencies is already more skewed than the ownership of Fiat-currencies. Poor people have no chance accumulating cryptocurrencies in a meaningful way. They have no money to get a phone or pay for the internet connection. Like gold, silver or even cash, what is the point if you have no money or job to begin with?

All transactions of Bitcoin and most other cryptocurrencies are public, and through KYC (Know Your Client) almost all identities of crypto owners are already known. To hide your identity - for example in Monero - will also be difficult, because the government can simply make Monero illegal and then use straw men to transact with you and arrest you.

The owners of the central banks already own the bulk of all relevant crypto and ca use “Bull and Bust” cycles to shake out all other users.

The government can force you to make your identity known before you enter the internet and trace your online activities on for example trade platforms. They can then ban your internet access if you seem to do unauthorized things.

The mining of many cryptocurrencies is a ridiculous energy consuming operation.

Supercomputers will likely break the encryption keys (that probably already have back-doors).

The money creation issue is not resolved with cryptocurrencies. A small group of people can create a lot of fiat and buy most of the crypto, meaning inflation will not be resolved and the same people will be able to manipulate politics as they did for centuries.

There is no social rescue net for people that have no money nor income,

The unnatural aspect of money (in the sense that it is not deteriorating) is not resolved.

If cryptocurrencies replace Fiat, then the criminals that stole all our wealth can keep their stolen goods, can keep their control of governments and will be rewarded with extra bonuses as they can now also predict all the crypto bull and bust cycles.

Like gold, silver and cash, also cryptocurrencies don’t provide weapons to fight the owners of the central banks. We - as Michel Foucault indicates - shouldn’t even be focusing on fighting or outsmarting this “Elite“. The only thing we need to do is to imagine a better system and leave all the nonsense behind. In a new system every transaction should be transparent to everybody. Privacy is mostly beneficial to the criminals. Instead of only allowing banks and governments to track all your transactions, we need to break that monopoly. Like we need to break the monopoly on printing money out of thin air.

The only real alternative to allowing a small group (banks and politicians) to look into our private dealings , is to allow everyone full insight in everyone’s financial transactions. This seems counter intuitive, but it is just plain logic that you can only see, if you can step over your own indoctrination.

18 February 2025

Teun van Sambeek MSc, MRE

Be updated about Copiania progress: Sign Up

We are aware that the generated pdf has page break issues. If you have any other remarks or see errors in the translation please: Contact Us

▲ Up ▲